Auto Sales – Impact from tariffs

Automobile Industry had a very difficult 2018.

Europe was flat but German Production is down 9% in 2018.

…

What about 2019 and brexit impact (specially for Germany)?

What about possible tariffs from the U.S. on European vehicles and Auto parts?

Let’s have a quick look at 2018 and before.

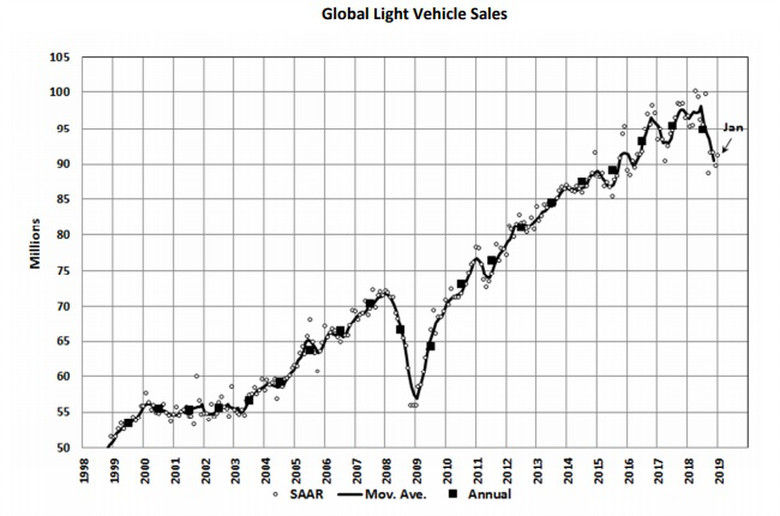

From LMC Automotive:

“Global Light Vehicle (LV) sales fell 8.2% in year-on-year (YoY) terms in January, although the selling rate rose to 91.2 mn units/year, from December’s 90.3 mn units/year.”

That gives you the following chart:

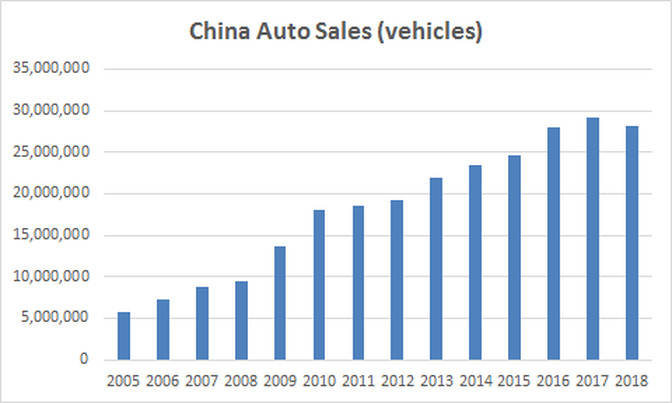

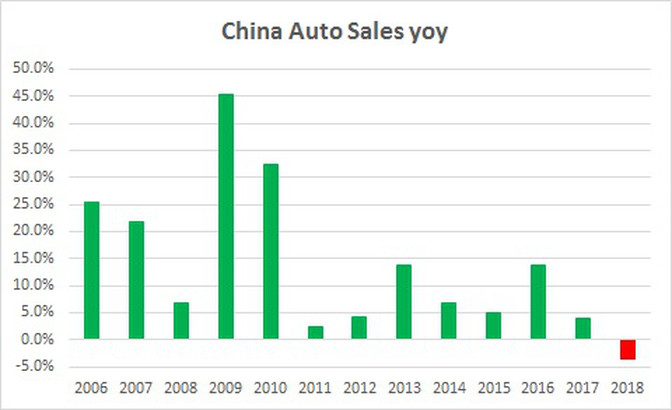

China Auto Sales are down 3.5% in 2018:

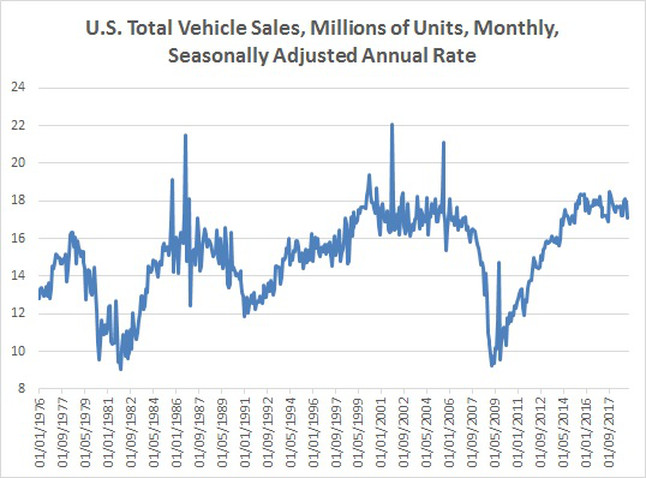

And for the U.S.:

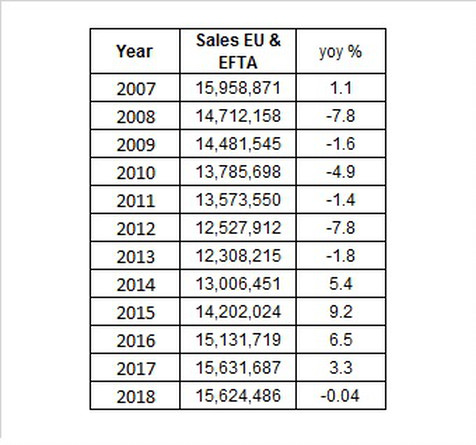

Europe, flat in 2018:

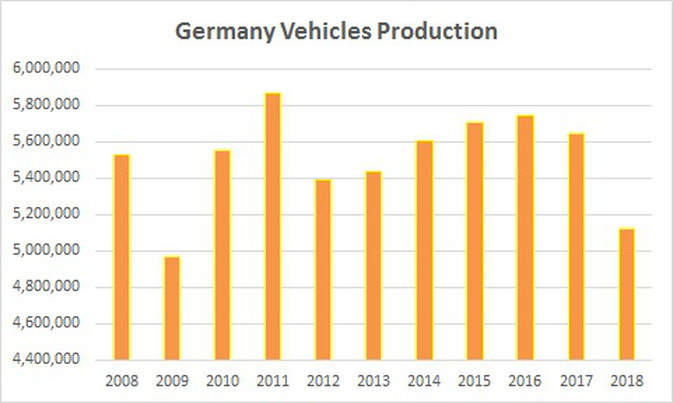

Germany:

Germany Vehicles production down 9% in 2018.

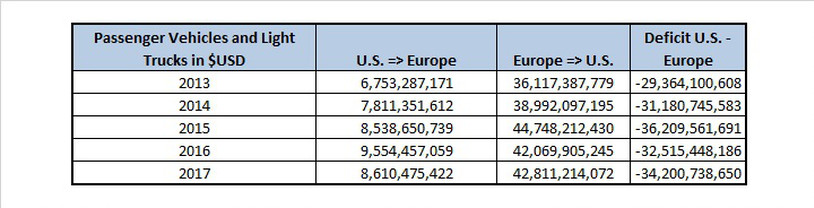

After this “global picture”, let’s have a look at U.S. – Europe Import/Export Situation:

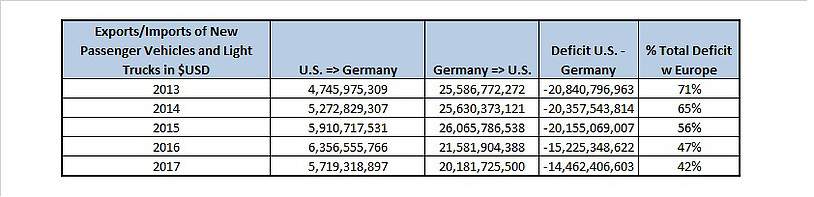

- Exports/Imports of New Passenger Vehicles and Light Trucks in $USD with Europe:

34bn deficit with Europe in 2017.

- Exports/Imports of New Passenger Vehicles and Light Trucks in $USD with Germany:

14bn deficit but represents in 2017 42% of deficit vs 71% in 2013 – coming down.

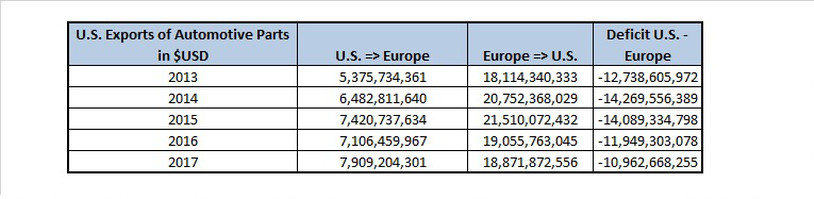

- U.S. Exports/Imports of Automotive Parts in $USD with Europe:

Coming down.

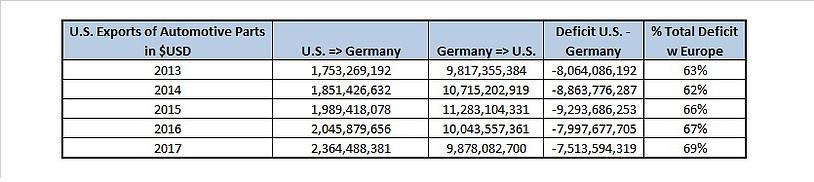

- U.S. Exports/Imports of Automotive Parts in $USD with Germany:

Roughly Stable.

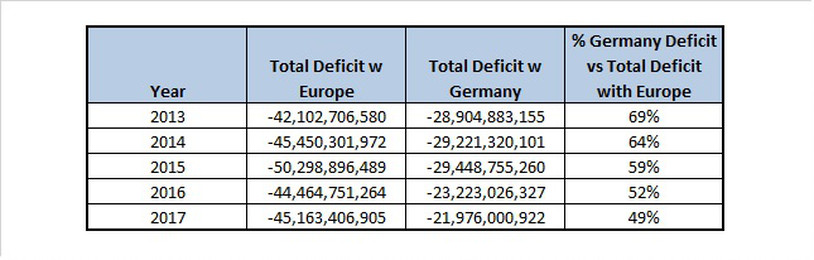

- Exports/Imports of New Passenger Vehicles and Light Trucks in $USD + U.S. Exports/Imports of Automotive Parts in $USD:

Good news for Germany is that it now represents ~50% of total deficit with Europe.

Bad news for Germanyis that Automotive (Vehicles + Auto Parts) made 30$bn of German exports to the U.S..

Bad news for Europe is it exports 60$bn woth of vehicles and auto parts to the U.S..

Bottom line is Germany will suffer from increase in tariffs but they won’t be the only ones in Europe.

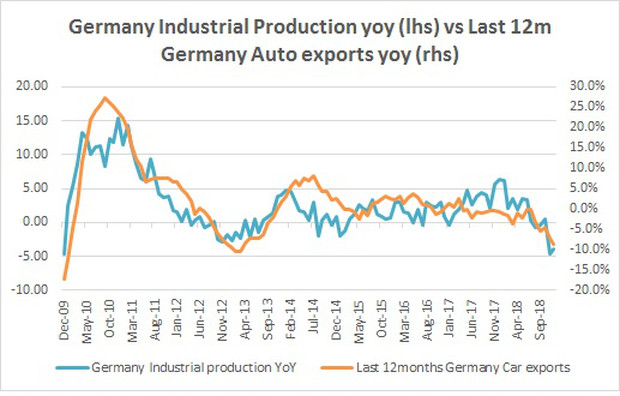

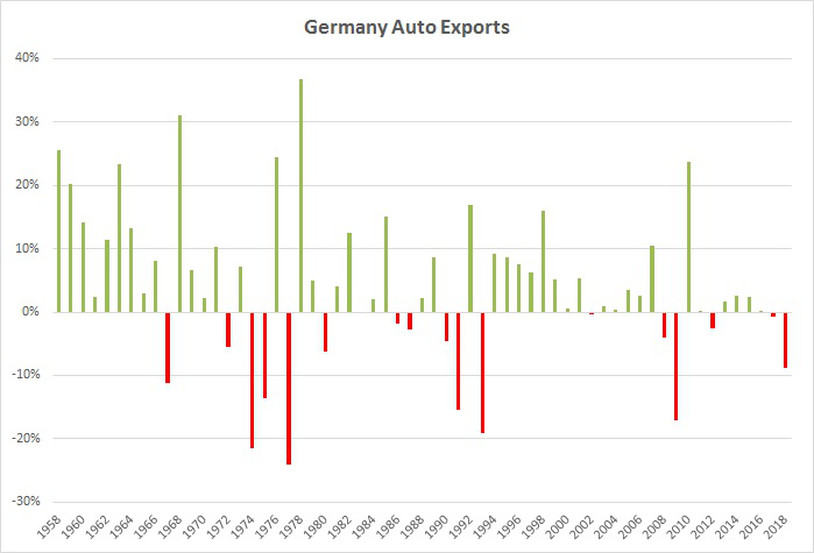

A quick look at Germany Auto exports will give you the following charts:

- Germany Vehicles-exports:

- Germany Auto Exports yoy:

Which gives you a very interesting chart:

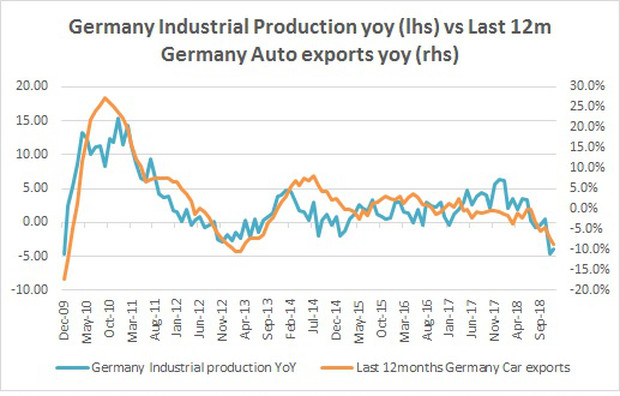

- Germany Industrial Production yoy vs Last 12m Germany Auto exports yoy:

In 2018, German car manufacturers produced 750k vehicles in the U.S. with 56% of them exported to Europe in China.

In the meantime, around 470k vehicles were exported from Germany to the U.S.. That represents around 12% of Total German vehicles exported and 9% of Total German Production.

With 820k people employed in Germany in the Auto-Sector, U.S. tariffs on Imports could have a devastating impact.

In 2017, U.K. made 769k of the exported vehicles, China 258k and the U.S. 494k.

Those 3 combined had 1.5m vehicles sold or 27% of the total German Production.

In that context, no doubt that brexit + China slowdown + possible of U.S. tariffs are affecting the German Auto Sector.

In conclusion, the slowdown of the Auto Market and the possible tariffs rise in the U.S. are affecting Germany and Europe.

Looking at the commercial surplus in that sector and the amounts involved (60b $), the next few months will be very important for Europe and Germany. If you want to see a bounce in Germany, you probably need a good Auto market.

Having said that, it is clear that the global slowdown is not only due to this sector issues.

I hope it helps,

Gregoire

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions