Banks… hmm…

Since the coronavirus breakout and the following lockdowns, there is no doubt that Banks have been massively hit.

But there might be more to come.

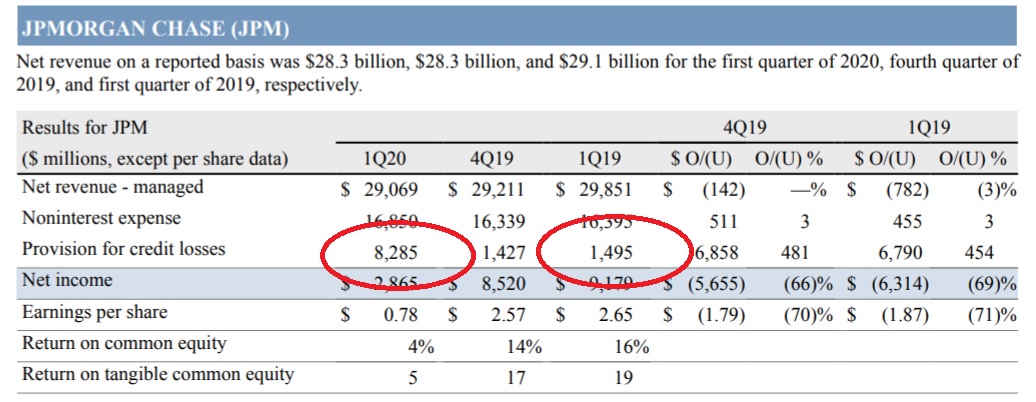

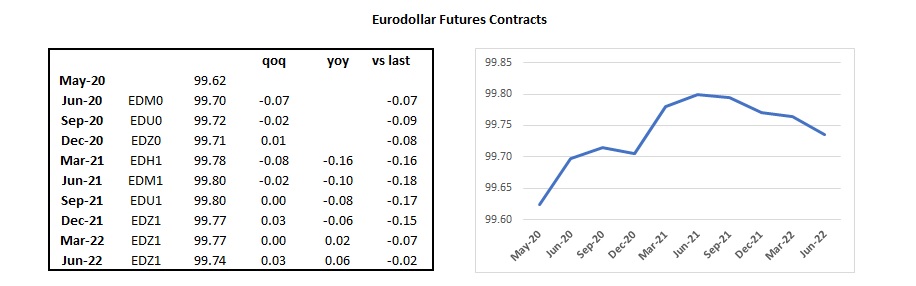

First, with the deterioration of the economy, many Banks will have to build more reserves for credit losses. As JP Morgan underlined during its latest earnings, “provisions for credit losses was $8.3 billion, up $6.8 billion from the prior year driven by reserve builds which reflect deterioration in the macro-economic environment as a result of the impact of COVID-19 and continued pressure on oil prices.”

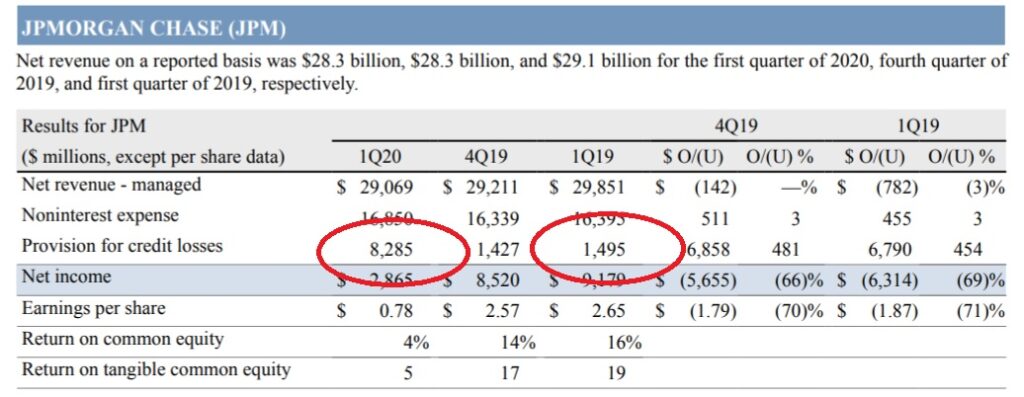

In the first quarter 2020, loan loss charges amounted $25.4B for the six big U.S. Banks.

From F.T. – US banks brace for surge in loan losses.(https://www.ft.com/content/87189e79-a442-44b9-a699-7bce47b5bc64)

Reality is there is almost no place to hide for Banks.

Secondly, even if that is not new, yields going lower and lower are not helping banks. Recently, the trend lower for longer has been accelerating and it looks more and more as if everyone is following Japan: lower for ever.

Example with the U.S. 2 Year:

Japan lead the way, followed by Europe and now with the U.S..

On Wednesday, the United Kingdom sold 3 year government bonds with a negative 0.003% yield.

| Last | |

| Germany 2Y | -0.695 |

| Switzerland 2Y | -0.652 |

| Netherlands 2Y | -0.619 |

| Austria 2Y | -0.562 |

| France 2Y | -0.526 |

| Sweden 2Y | -0.407 |

| Spain 2Y | -0.404 |

| Portugal 2Y | -0.317 |

| Japan 2Y | -0.173 |

| U.K. 2Y | -0.071 |

| U.S. 2Y | 0.167 |

| Singapore 2Y | 0.254 |

| Australia 2Y | 0.285 |

| Canada 2Y | 0.314 |

| Hong Kong 2Y | 0.326 |

| Italy 2Y | 0.526 |

| Thailand 2Y | 0.54 |

| Poland 2Y | 0.59 |

| South Korea 2Y | 0.819 |

| Vietnam 2Y | 1.391 |

| China 2Y | 1.675 |

| Philippines 2Y | 2.769 |

| Brazil 2Y | 3.82 |

| India 2Y | 4.308 |

| Russia 2Y | 4.67 |

| South Africa 2Y | 5.09 |

| Mexico 20Y | 6.96 |

| Turkey 2Y | 9.18 |

There is no doubt that negative yields have been a killer for European Banks. Since last September and tiering for example, the ECB has been trying to give a bit of relief to the European Banking System. Never too late I guess.

In theory, a steepening of the yield curve should help Banks and the recent U.S. steepening might be good omen.

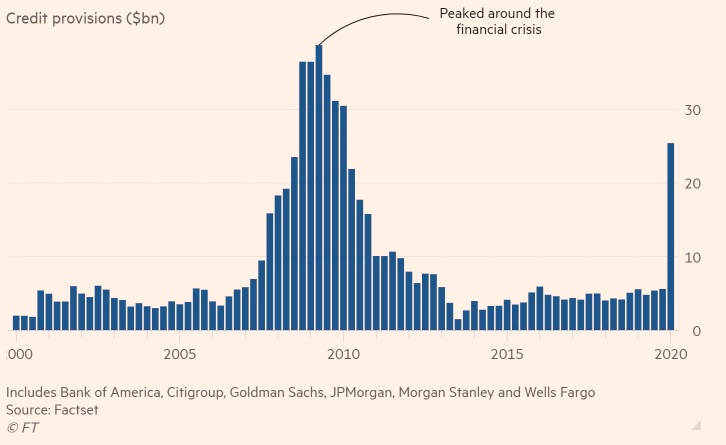

But there are many Buts here. To name a few: the long dated Treasury Yields are higher mainly because of the amount of supply coming from the Treasury Department to finance its huge deficit, eurodollar futures are telling you that this situation is here to stay for quite a long time. Forget the V-Shaped Recovery, market is now pricing the Fed to be on hold for the next 3 years.

No surprise that the Banks’ price action has been very weak recently. They did not recover.

In the U.S., with the Dow Jones U.S. Banks Index – DJUSBK.

In Europe with the Stoxx 600 Banks – SX7P.

In Europe, there are some concerning price actions:

Santander – SAN.MC

Societe Generale – SOGN.PA

Sabadell – SABE.MC

There are many charts in Europe like those ones…

No Deutsche Bank here which has been the best performer ytd. Down less than 5% in 2020.

But to be honest, some price actions in the U.S. are not great either.

Wells Fargo – WFC

The bottom line is that economic recessions and negative yields (or close to 0) are not helping the Banking Industry across the world.

The Equity Market is mainly driven by Technology Stocks and some growth names. There is no doubt that growth should be trading at a premium. As always question is the level of premium.

I might be old school here but I still want to believe that with Banks so weak it will be hard for the overall market to ignore this price action for too long. That is a clear signal that the situation is bad and will stay probably this way for quite some time.

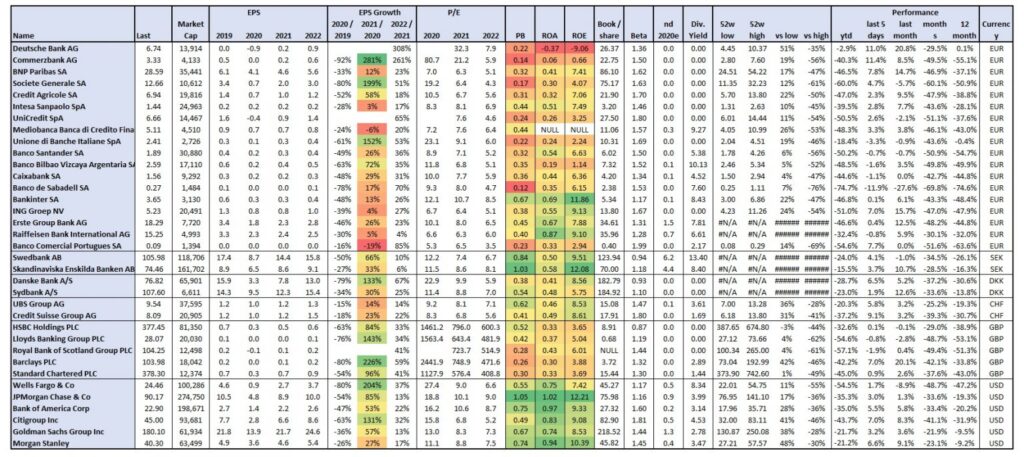

As always when looking at Banks, here is a snapshot:

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions