Webinar: Trade Idea Generation 2024

>> Register here << Date: Jan 13, 2024 Time: 02:00 PM London –…

VIEW POST

Group Mentoring Session September 23

Group Mentoring Session When? Saturday the 30th of September 2023 at 1pm u.k.…

VIEW POST

Webinar: 10 Trading Lies Keeping You from Making Money

>> Register here << Date: Jun 01, 2023 Time: 08:00 PM London –…

VIEW POST

Webinar: Idea Generation for 2023

>> Register here << Date: Jan 07, 2023 Time: 01:00 PM London –…

VIEW POST

Group Mentoring Session #3

Group Mentoring Session #3 When? Saturday the 17th of September at 1pm u.k.…

VIEW POST

Webinar: Markets Thursday June 16

>> Register here << Date: June 16, 2022 Time: 06:00 PM London Fee:…

VIEW POST

Daily Comments – 20/05/2022

U.S. Stocks Futures +1.0% Bouncing after testing recent lows, no new lows so…

VIEW POST

Daily Comments – 19/05/2022

U.S. Stocks Futures -1.5% And retesting recent lows, risk-off with stocks down, bonds…

VIEW POST

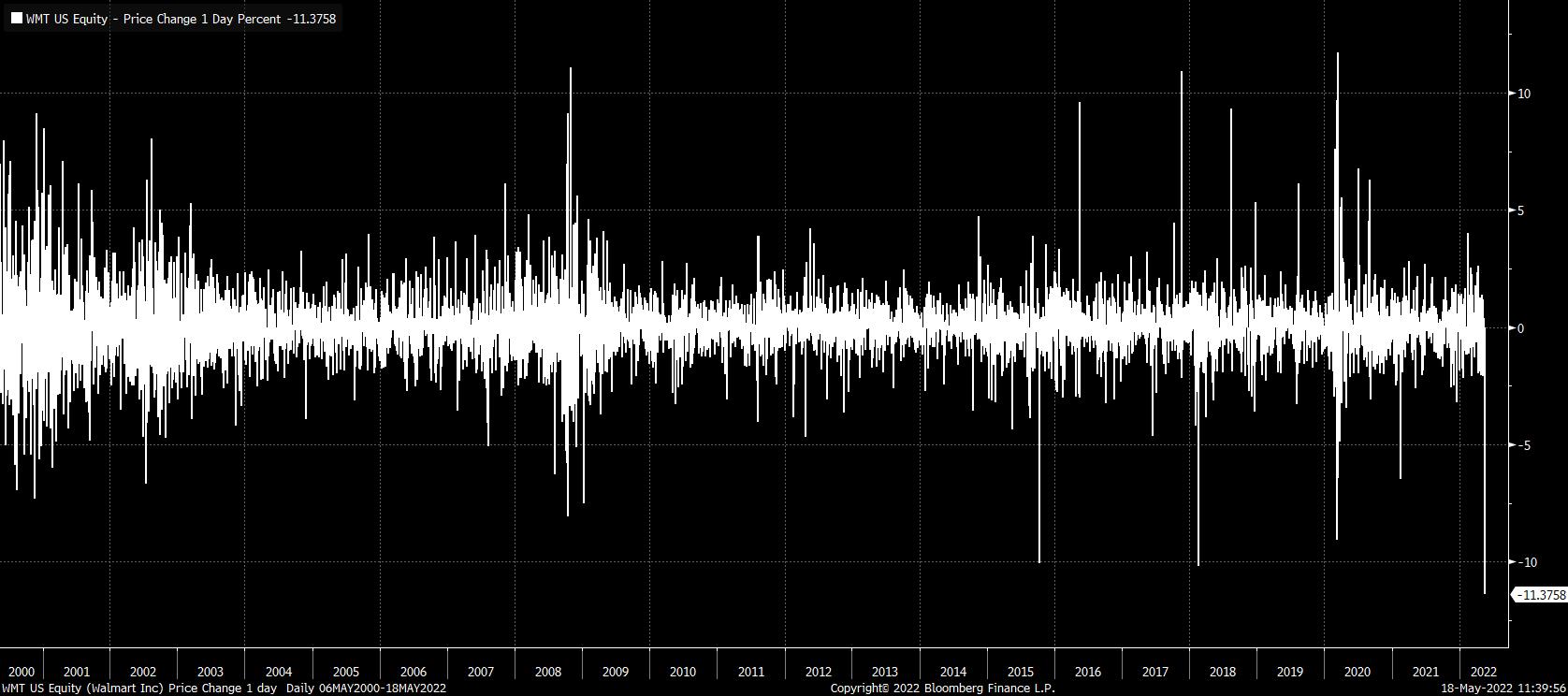

Daily Comments – 18/05/2022

U.S. Stocks Futures -0.2% Consolidation after last 3 sessions Rally Nasdaq Futures last…

VIEW POST