China, Emerging Markets, Caterpillar.

Yesterday, the stock collapsed 9% after bad earnings and outlook.

Over the last 12 months, the stock is down 24%.

To make any trader happy, let’s do a bit of backtrading or some “I told you so” from BBC or Bloomberg…:

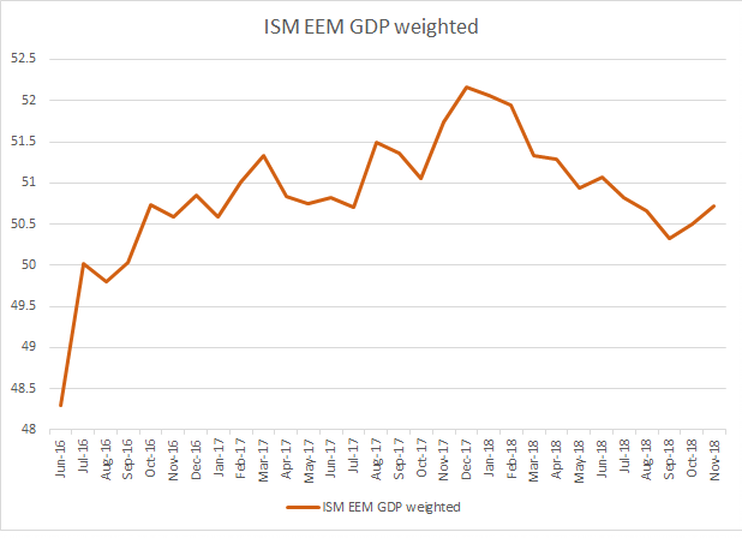

First thing first, ISM from Emerging Markets peaked in January-February 2018.

Very similar to Europe peaking last year.

Differences are Emerging Markets experienced strong FX pressure from March onwards and, ex. China they have been stabilizing since September 2018.

ISM China:

Last 3 months, China is slowing more whereas other Emerging Markets stabilizing.

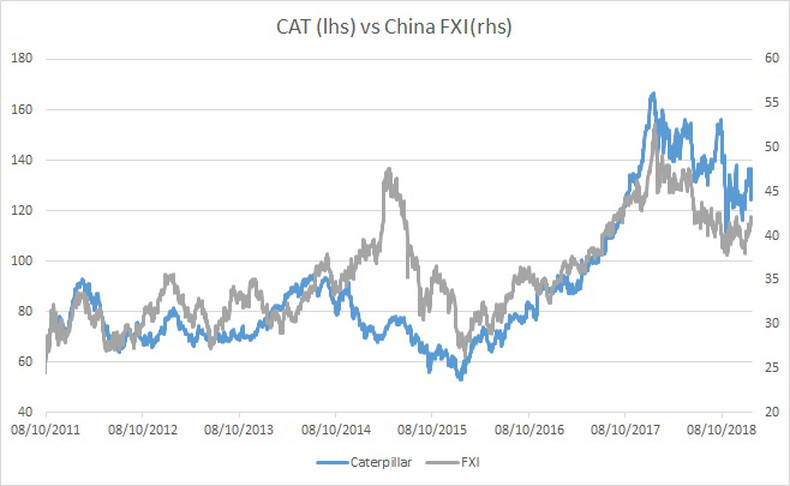

It has been hard for any company with Chinese exposure last few months.

What about Caterpillar exposure to Asia/Pacific and China?

From their 4Q 2018 Earnings release:

During the last quarter, 26% of sales were originated in Asia/Pacific.

That was 20.9% in 2016 and 21.5% in 2017.

Clearly, to “play” Caterpillar you need to look at Asia/Pacific and China.

And yes China is slowing.

Now, have a look at the following charts:

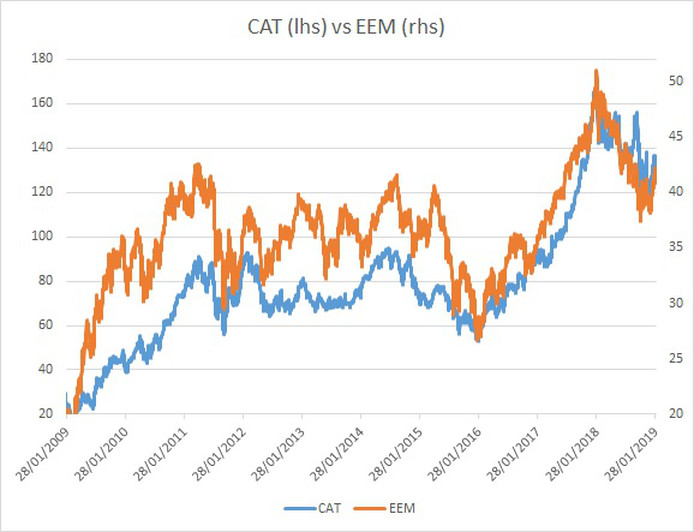

- Caterpillar vs EEM last 10 years:

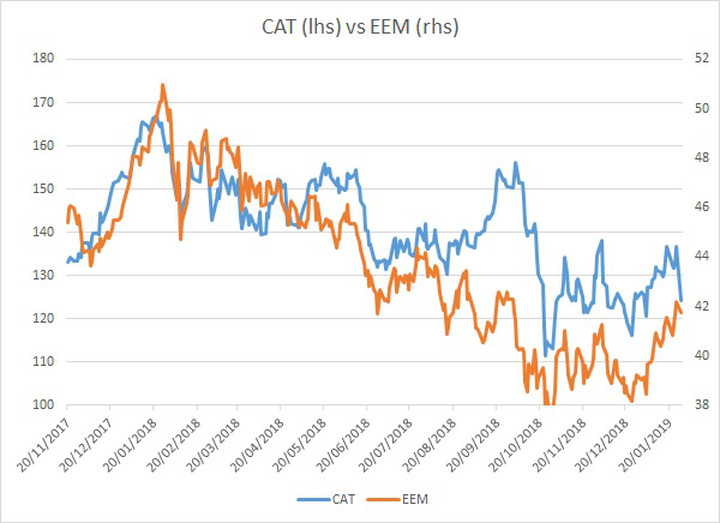

- Caterpillar vs EEM last 2 years:

- Caterpillar vs China:

Caterpillar is known for giving a big macro update during their earnings call. So if you want to know how the world is doing, always good to listen to their conference calls.

When you invest in Caterpillar (long), you want the global economy to do well and specially emerging markets.

If you are looking for the next trade, have a look at the correlation between Caterpillar (CAT) and Deere (DE).

I hope it helps,

Gregoire

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions