European Banks: is there any hope here?

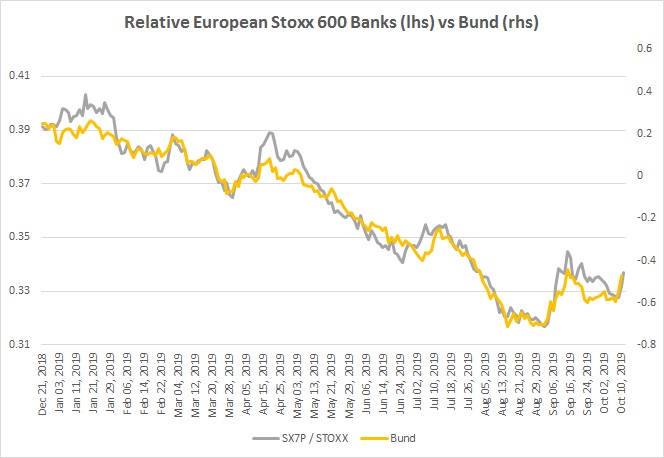

Let’s start with the Chart of the Week – all the credit here goes to @fwred

Not new here but with a good chart we can clearly see the obvious: there has been a massive correlation between the performance of European Banking Sector and yields (or bund here).

Negative yields are not helping (euphemism) European Banks.

Meaning that for turning positive on European Banks, you need to turn bearish on the Bund = yields going up.

And this is what you are going against:

As some of you know:

But I have some indicators that tell me it could be different this time.

First, one of the best traders I know, told me on the 12th of September during the last ECB meeting that bund was probably making a decent top. Then we had a reversal on that day. And guess what? we have not seen new highs since then.

The second indicator is for me the tiering decided by the ECB (on that same day) which should massively be helping the European Banks by offseting negative interest rates. On top of that, since it has been announced, my view was that tiering will mechanically bring selling pressure on the Bund as they could now park their money at 0%.

But I agree: a lot of theory so far and price action is midly convincing. Both on a Sector Level:

Where we recently retested the 115 lows.

Or when you look at charts of Commerzbank, Deutsche Bank, Societe Generale…

So yes long term chart is not great and fundamentals have not changed. But both are improving and to say that investors are underweight that sector is another euphemism.

I am not calling for this time is different but at least 115 as a stop offers a good risk management with limited downside.

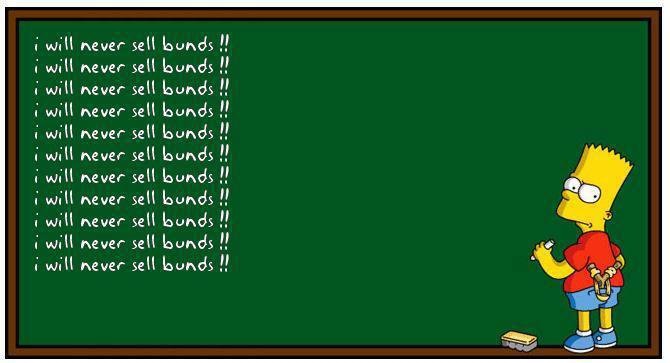

Finally if you want to do some intra sector building, you could be looking at this:

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.