Realized Volatility vs Implied Volatility. Where are we?

I just wanted to make a quick comment on market’s conditions as we recently experienced falling volatility. That is true across asset classes where volatility stands at low level. Below we will be looking at the S&P 500 volatility: realized and implied.

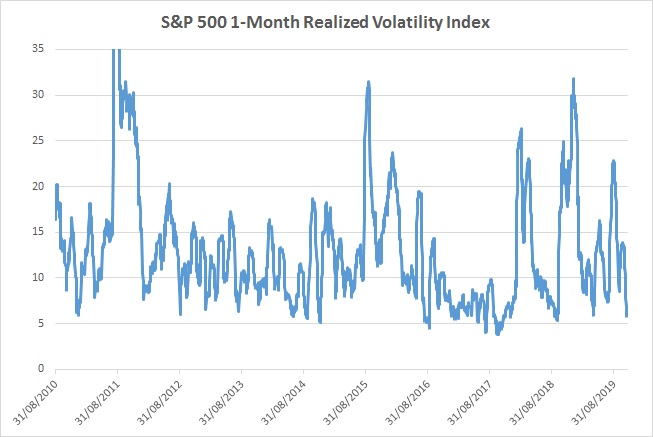

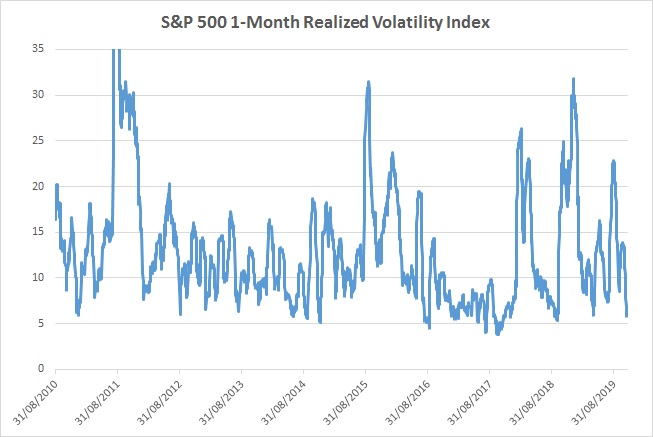

Let’s start with a chart for the S&P 500 1month Realized Volatility:

For the last 10years, S&P 500 1-Month Realized Volatility has averaged ~13%.

At the close of yesterday (19/11/2019), the 1-Month Realized Volatility stood at 6.27%. To put things into perspective, this level of realized volatility happened only 10% of the time since 2010.

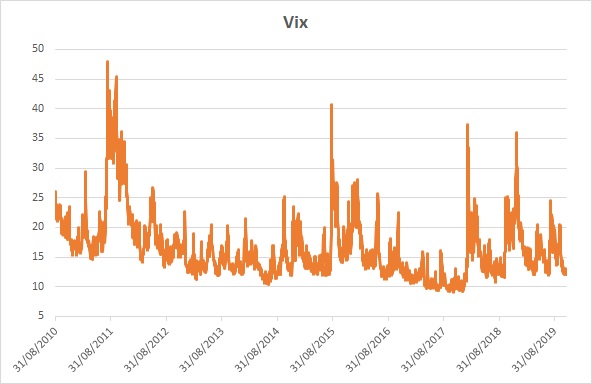

What about the 1month Implied Volatility for the S&P 500? Through the Vix:

Here we are standing at low levels but still not at the 10 level or below experienced in 2017 for a long period.

From 2010 to 2019, 86% of the time implied volatility was higher than realized volatility. So almost 9 times of of 10, realized volatility is below implied volatility.

In the chart below, the delta between Realized Volatility (RV) and Implied Volatility (IV) would be represented below by the grey Clustered column. For the realized volatility to jump above the implied vol, you need a proper jump in volatility. At the moment, the differential between Realized and Implied is around 7% or for the last 10 years less than 20% of occurrences.

Why is normally Realized Volatility below Implied Volatility? That can be explained by two things mainly: the limited downside of the option’s buyer vs unlimited downside for the seller, and some errors/distortions due to the Black and Scholes Model (which assumes market returns are normally distributed) .

The above charts for the realized volatility and the implied volatility show that those low levels can stay low for a prolonged period and even go lower. For example, I painfully experienced that in 2017 and some of you will remember other episodes of low volatility like 2005.

For the recent period, it is fair to say that the recent dampening of volatility coincides (strangely or not) with more Central Banks intervention around the world since September 2019: like new round of Quantitative easing in Europe, reinvestment in the U.S. and repo intervention…

But what happened in 2019 when we had similar realized volatility?

The chart below shows how the S&P 500 did in 2019 when the one month implied volatility reached similar levels:

In May, the S&P 500 went down by 7%.

In August, the S&P 500 experienced a 6% fall.

No big corrections but rather limited downside.

Again, it is important to reiterate that Central Banks have been much more active over the last couple of months and it is hard to see in the short-term a reversal in their interventions. Recent history like 2017 has shown that low volatility can stay here for quite a extended period.

Nonetheless, if you want to build bearish positioning or you want to hedge your overall exposure, this is where we stand at the moment. The 90th percentile. As always with insurance, it might expire worthless but at this level, the costs are offering good risk reward. It is true to say that vs realized volatility, implied volatility (hence premium) could go lower but this is about risk reward: upside vs downside.

Now that we are going into the last expiry of the year, it is worth checking the different open interest and the effects of how dealers are positioned with their gamma.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions