Short-Term Trading: possible if realistic.

I have been in the industry for long enough to know that long-term fund managers will portray anyone with a shorter timeframe as traders and traders will portray anyone with a shorter mandate as intraday traders. On the other hand, traders will make fun of portfolio managers who are unable to trade volatility and will do even worst when there is a spike in volatility.

In reality, everyone would love to add performance to its global portfolio (with core positions) with an active trading. Active trading around existing positions and arising from new market conditions.

For doing that, It is important to know which return we could realistically expect from any timeframe. Obviously, the shorter the timeframe, the lower the return should be. Plus you will have to to take into account costs of trading (a big deterrent if you trade short-term), the tools you are using, the risk management, the risk reward of the trade…

In that sense not every market will allow short-term trading. Market’s conditions change and volatility for asset classes and for single asset are evolving. That is the market’s beauty: always something new and very often at a new place. For traders looking for short term trading, spotting where is the volatility is crucial. Still spotting something does not necessarily mean making money out of it. Still, that is a good first step.

Short term traders will obviously benefit from an overall rise in volatility but they still can move around asset classes’ volatility and/or volatility changes on single names.

For any investor, trader, it is essential to adjust expectations with reality. Here avoid the noise (despite twitter, news, friends, tv…) that looks tempting but will only generate losing trades. For example, when there is not much volatility on eurusd, do not try to make 1% intraday as it will take you two days to target those returns. In that sense, Fx market with its liquidity, the possible leverage and trading 24h is very tempting. Do not fall into it and check the facts first.

To trade short term, you REALLY need to have an advanced setup: direct access to the market, strong IT support, squawk box, top trading software… If you do not tick all the boxes, avoid it as something wrong will happen down the line. That does not mean you are a bad investor or trader, but just that you have not the proper set up. Each mandate requires a different set-up.

Even if that is no news, stocks offer much more opportunities than any other asset class. This is a question of risk reward:

– first, the universe is much, much bigger than any other asset class: 2,500 or more U.S. stocks with a market capitalization above 3bn vs 7 Major FX pairs for example.

– secondly, the volatility is much higher for stocks as we will illustrate below.

To validate that point, let’s have a quick look at recent daily Average True Range across asset class:

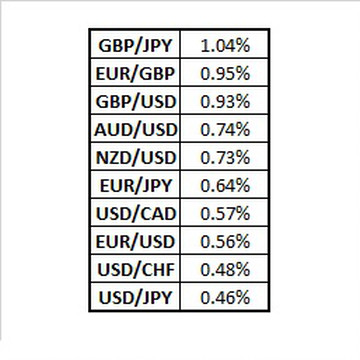

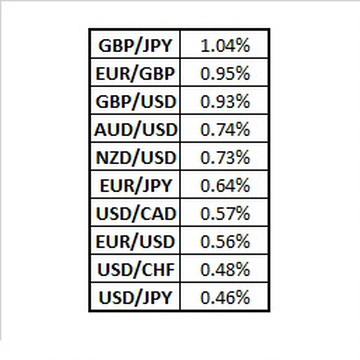

– Foreign Exchange:

Here GBP is leading the recent pack… no surprise here with brexit.

Higher Volatility than Fx with a wide range and Gold at the bottom.

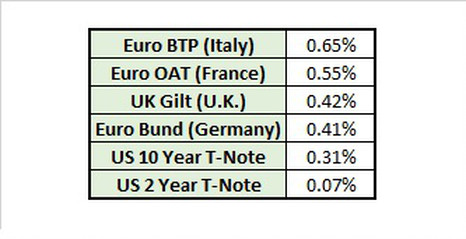

– Bonds:

1/2 the Fx volatility and following the recent “macro” development.

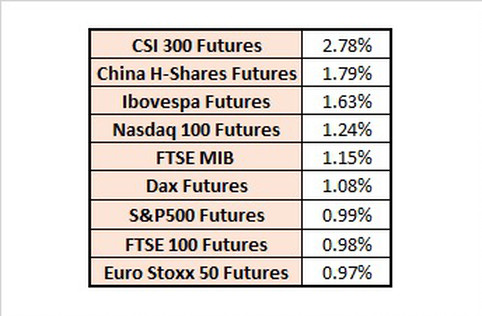

– Stock Indexes:

Topping ATR of almost all Fx pairs above.

Emerging Markets leading and S&P500, FTSE 100, Euro Stoxx 50 showing great correlation and similar numbers.

What about single name stocks?

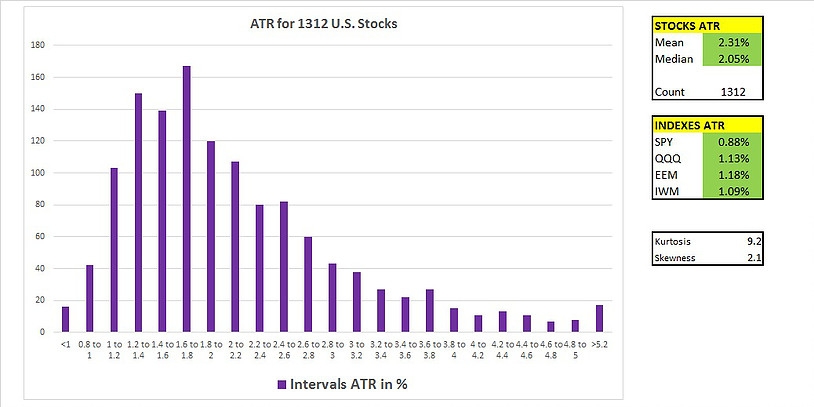

That was the picture for 1,312 U.S. stocks at the close of the 13th of March 2013:

– Out of this 1,312 stocks, only 23 of them had a daily ATR lower than 1.04% (or the GBP/JPY ATR).

– 98.25% stocks at an higher ATR than the most recent volatile FX pairs seen above.

– 43% of the stocks universe showing more than 2% ATR or 2x GBP/JPY ATR.

Still with the recent drop in volatility and compare with recent spikes (cf. blog: Yes, Volatility is back! (update)), stock offers much lower trading opportunities than 3 months ago for example. When the VIX is at 13, there are obviously less trading opportunities in the short-term than when it is at 21.

But with the VIX around 13-14 and 43% of stocks with an ATR of more than 2%, that is not a bad universe. Idea here is to understand that we are looking for 1 to 2% return on the day.

But again that is not for everyone and possible for all strategies.

If you do not realize this, you will adopt a bad risk management that will generate accumulative loses and high costs of trading.

Depending on your timeframe, knowledge, setup… just check what is a realistic return. Then you will decide if the risk reward is good enough to follow that strategy.

I hope it helps,

Gregoire

Sub Section Title Here

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

ACCESS FREE LECTURESUBSCRIBE

TO OUR BLOG

To receive opinions, market research, and data analysis in the Financial Markets

ABOUT

DUPONT TRADING

As a Professional Trader/Portfolio Manager/Hedge Fund Manager for almost 20 years, I know that learning how to Trade/Invest is a non-ending learning curve. This adventure is extremely exciting but needs to be ridden carefully.

In January 2018 after receiving many requests, I decided to start my own mentoring activities.

In October 2019, I launched the 4×4 Video Series to help Investors profitably manage their portfolios. By sharing my ideas/experiences and offering education through the 4×4 Video Series, I hope I can help you becoming a better investor.

Students

Testimonials

M. (Singapore)

LEARN ONLINE TRADING TODAY. THE PROFESSIONAL WAY.

Let us solve the problem and confusion around trading and finance management, the right way.

Reader Interactions